Depreciation net book value formula

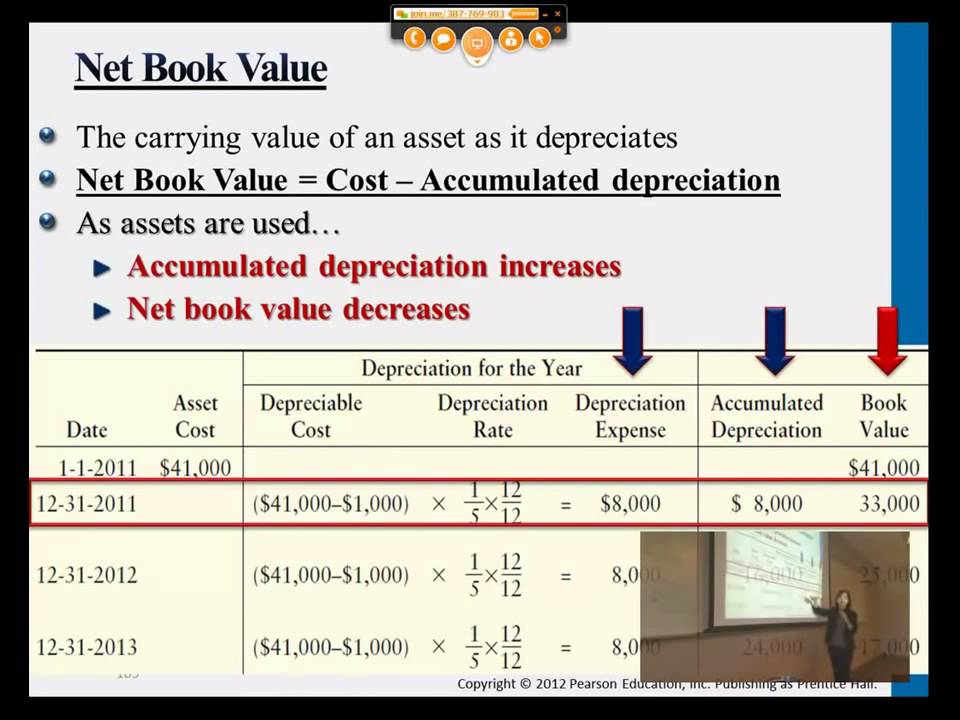

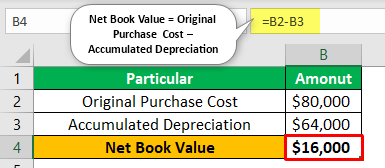

Book value of an asset is the value at which the asset is carried on a balance sheet and calculated by taking the cost of an asset minus the accumulated depreciation. To present it into an equation.

Depreciation Expense Double Entry Bookkeeping

B P1 α t.

.jpg)

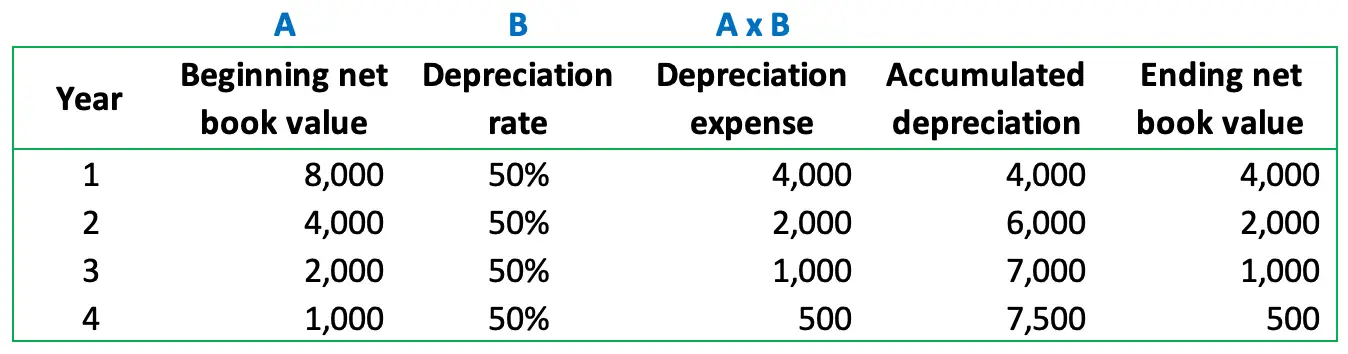

. To calculate the assets net book value at the end of the fourth year. The formula to calculate net book value is. I had the same issue and have doing following settings for depreciation in order to calculate depreciation based on NBV instead on ACQ value.

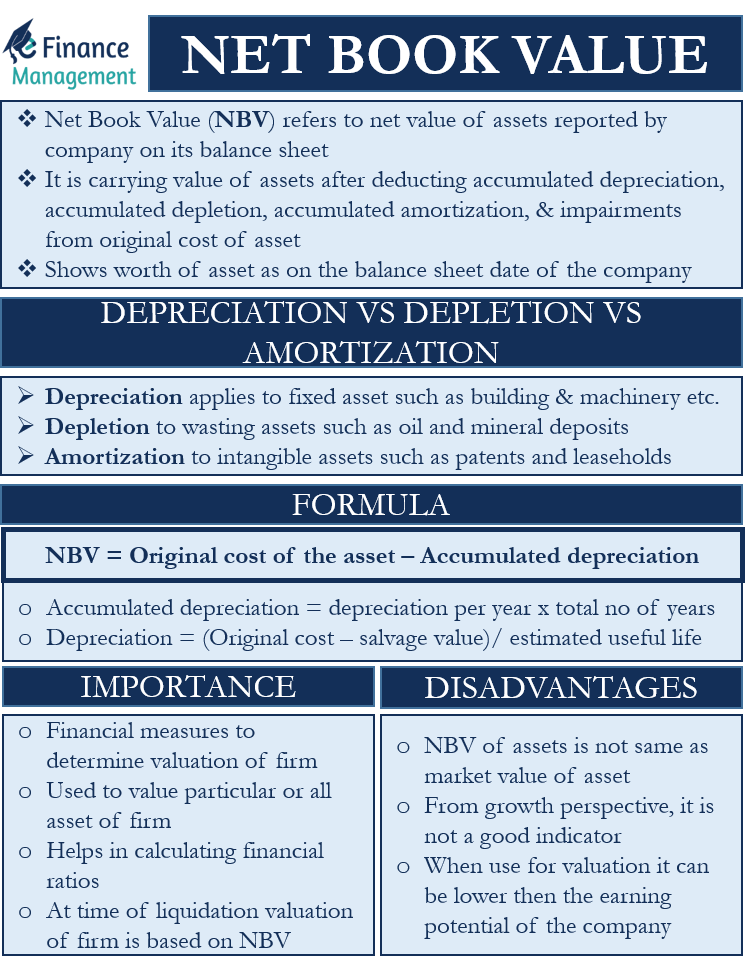

Net Book Value Of Machinery Acquisiton Cost Accumulated Depreciation Impairment Losses. Net book value is calculated as the original cost of an asset minus any accumulated depreciation accumulated depletion accumulated amortization and. Book Value of Assets.

Book value can be calculated by using the formula. To compute for book value four essential parameters are needed and these. B P - P - The image above represents book value.

Net book value of machinery 140000 USD. Key LINR Str-line from. The formula for calculating book value.

Determine the useful life of the asset. B Book value of an asset P Present worth or amount α rate of depreciation t Number of years of the asset. Conceptually depreciation is the reduction in the value of an asset over time due to elements such as wear and tear.

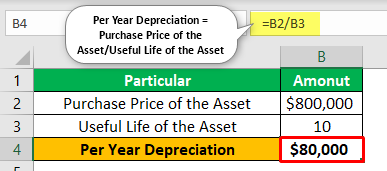

Lets start by calculating the original cost of an asset. Scrap Value of Assets. Depreciation Rate 20 straight.

NBV Original cost of the asset Accumulated depreciation Where Accumulated depreciation depreciation per year x. Net book value is defined as the carrying value of the asset on the balance sheet of the company and is calculated as the original cost of the asset less the accumulated. You can create a diminishing value method to calculate tax depreciation using a reduced rate in the initial period year of acquisition.

This means that the vehicle is depreciating at 6250 per year 25000. Subtract the estimated salvage value of the asset from the cost of the asset to get the total depreciable amount. For instance a widget-making machine is said to depreciate.

The original cost of an asset includes the original cost of acquisition. The amount of depreciation may be calculated by using different. The formula for calculation of NetBook value NBV.

It was purchased for 25000 and it is depreciating at 25 with the straight-line method of calculation. Book Value Cost - Accumulated Depreciation. This means it should reflect more or less the amount you would receive if you sold the asset on the.

Accumulated Depreciation 72000 USD. The formula for calculating the net book value of an asset is to deduct the amount of accumulated depreciation from the cost of the asset. Net book value represents the theoretical value of what an asset is worth.

The formula for calculating book value. Divide the sum of step 2.

Net Book Value Meaning Calculation Example Pros And Cons Efm

Reducing Balance Depreciation Calculation Double Entry Bookkeeping

Calculate Double Declining Balance Depreciation Accountinginside

Net Book Value Professor Victoria Chiu Youtube

How To Calculate Book Value 13 Steps With Pictures Wikihow

.jpg)

Net Book Value Nbv Definition Meaning Investinganswers

Depreciation Formula Calculate Depreciation Expense

How To Calculate Book Value 13 Steps With Pictures Wikihow

How To Calculate Book Value 13 Steps With Pictures Wikihow

Net Book Value Meaning Formula Calculate Net Book Value

Net Book Value Professor Victoria Chiu Youtube

Depreciation And Book Value Calculations Youtube

Net Book Value Meaning Formula Calculate Net Book Value

Disposal Of Fixed Assets Journal Entries Double Entry Bookkeeping

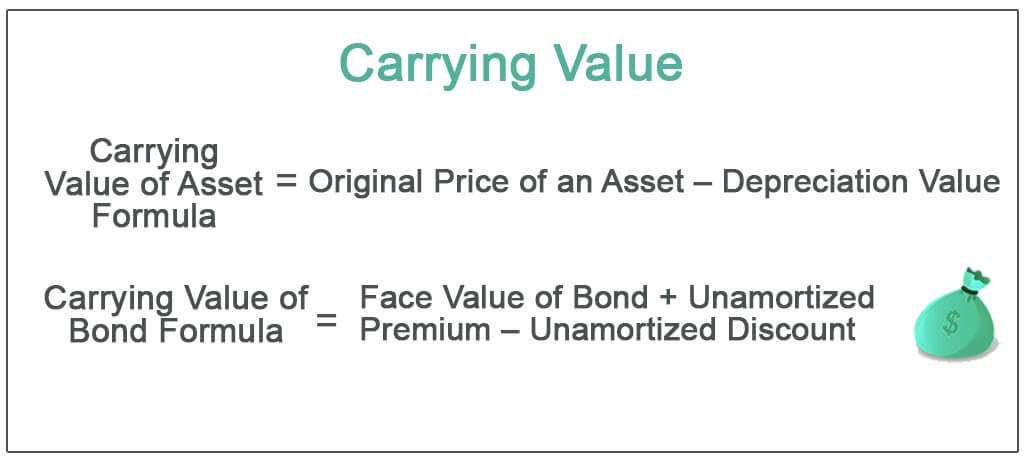

Carrying Value Definition Formula How To Calculate Carrying Value

Net Book Value Meaning Formula Calculate Net Book Value

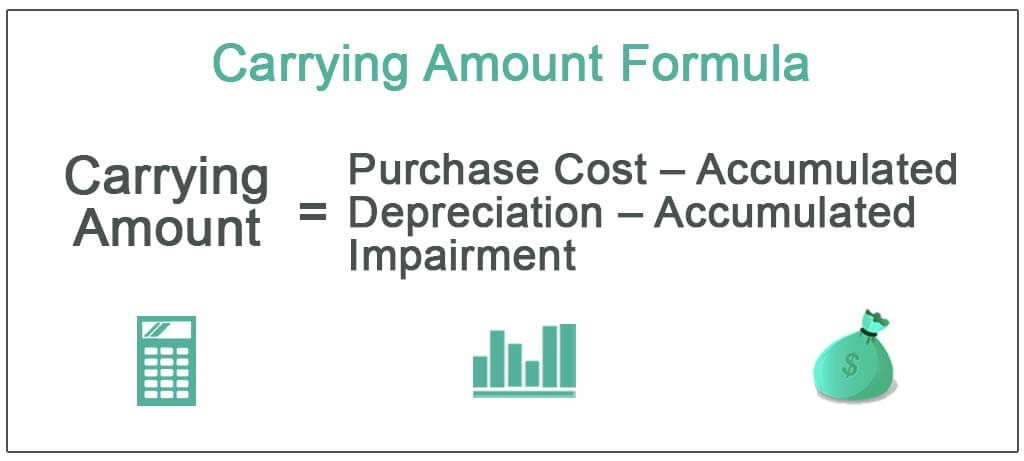

Carrying Amount Definition Formula How To Calculate